Snacklins – Plant Crisps

DEAL

EPISODE SUMMARY

🕓 Air Date: October 20, 2019

Asking For:

$250,000 for 2,50%

Investor:

Mark Cuban

Deal:

$250,000 for 20% + extra $50,000

PRODUCT SUMMARY

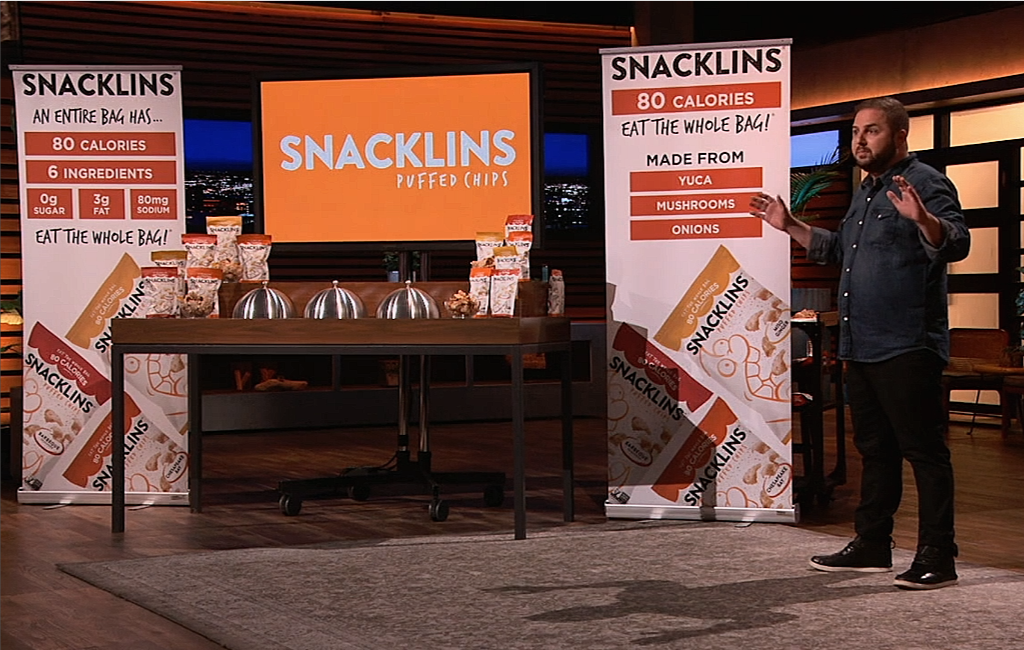

Snacklins offers a healthier alternative to traditional pork rinds, made from real ingredients like mushrooms, onions, and yuca, with each bag containing only 80 calories.

WATCH HERE

IN A RUSH?

Click these to jump to the section you want to read.

Background Story

Samy Kobrosly, hailing from Rockville, Maryland, was inspired to create Snacklins when, as a Muslim, he couldn’t enjoy traditional pork rinds or chicharrón. Determined to make a healthier version, he crafted Snacklins using real ingredients like mushrooms, onions, and yuca. The idea stemmed from a desire for a guilt-free alternative to popular but unhealthy snacks. The Snacklins team, a close-knit family, has grown rapidly and garnered support from employees, angel investors, friends, and family.

The Product

Snacklins are a unique and healthy snack, offering the crunch of traditional chips without the guilt. Made with fresh ingredients and featuring flavors like Chesapeake Bay barbecue and miso ginger, Snacklins provide a satisfying umami taste from the mushrooms. What sets them apart is the low-calorie count – a whole bag is only 80 calories.

The product’s affordability, coupled with its presence in major chains like Whole Foods, Walmart, and 7-Eleven, reflects its growing popularity. Priced between $1.99 and $2.29, Snacklins’ cost is approximately 90 cents per bag. The company has invested in building its own factory, a unique approach in the industry, to ensure control over quality and production.

How It Went

The company’s position before Shark Tank

Snacklins has experienced significant growth, increasing sales from $200,000 to an estimated $2 million within a year. With a diverse range of partners, including mom-and-pop stores and major retailers, Snacklins has expanded to approximately 850 stores nationwide. The company’s commitment to creating American jobs is evident in its decision to build its own factory, a move that reflects its dedication to quality and control over the production process.

Despite facing challenges in the competitive food industry, Snacklins has maintained a 30% gross margin and raised $1.5 million to date. The current valuation of $10 million may seem high, but the company’s rapid growth and innovative approach to manufacturing justify the figure. Snacklins is 11-12 months away from profitability, seeking a strategic Shark to navigate the challenges and provide the necessary funding for the final push.

The Negotiations:

The negotiations began with Samy seeking $250,000 for 2.5% of Snacklins. The Sharks were intrigued by the unique product but raised concerns about the valuation and the challenges of the food industry. Mark Cuban expressed interest but was not satisfied with the offered equity. After three Sharks bowed out, Mark Cuban made a counteroffer of $250,000 for 5% straight equity and 5% advisory shares vesting over three years.

Samy, recognizing the value Mark could bring, accepted the deal. The negotiation showcased Samy’s determination, the challenges of the food industry, and Mark Cuban’s strategic insight, resulting in a successful partnership.