Fixed App for Parking and Traffic Tickets

DEAL

EPISODE SUMMARY

🕓 Air Date: January 15, 2016

Asking For:

$700,000 for 5%

Investor:

Mark Cuban

Deal:

$700,000 for 7%

PRODUCT SUMMARY

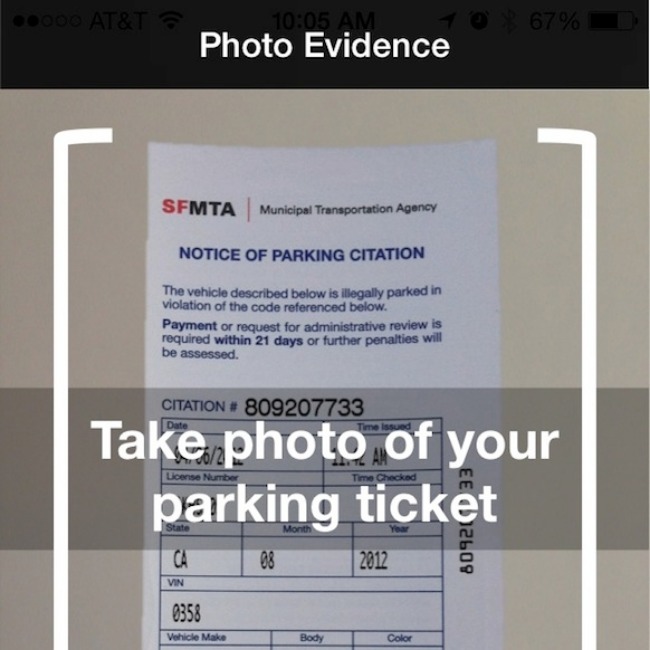

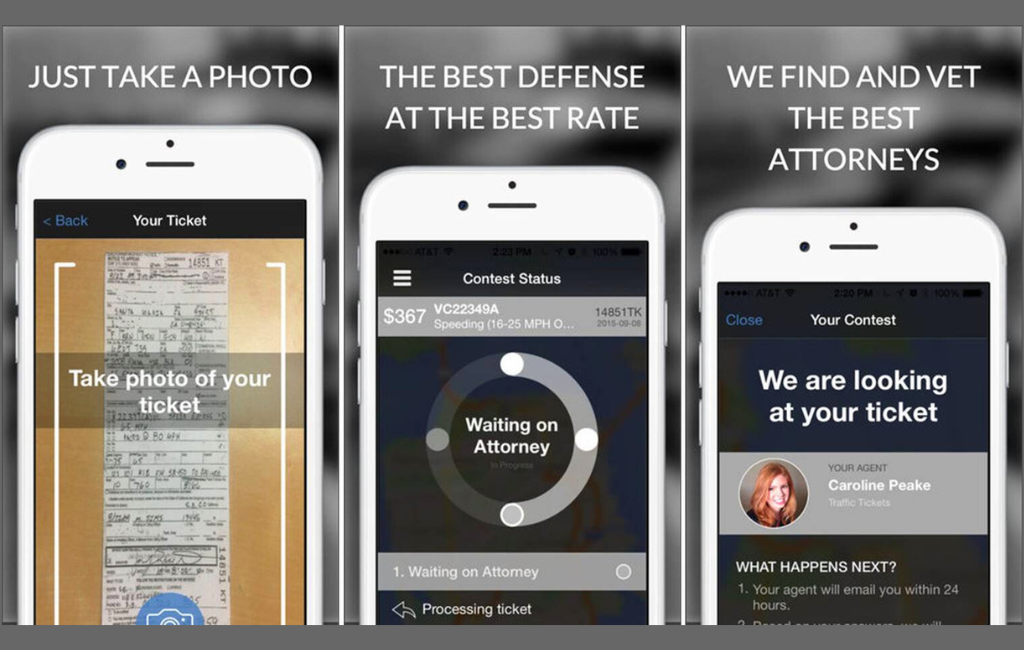

Fixed is an app designed to contest parking tickets by taking a photo of the ticket, running it through a proprietary algorithm to identify issues, and sending a contest letter on behalf of the user to the city.

WATCH HERE

IN A RUSH?

Click these to jump to the section you want to read.

Background Story

Fixed was pitched on Shark Tank by David Hegarty from San Francisco, California. The founder aimed to address the frustration and perceived injustice associated with parking tickets. Hegarty highlighted the common grievances people feel when slapped with a parking ticket – the intentional confusion of parking signs, meter attendants waiting for expiration, and the sense of helplessness in the face of what feels like an unjust penalty.

Hegarty, as the founder, brought his tech solution, Fixed, to the Tank seeking a $700,000 investment for a 5% equity stake. The product’s premise was to simplify the process of contesting parking tickets. Users only needed to take a photo of their parking ticket, and Fixed’s proprietary algorithm would identify errors that could render the ticket invalid. The app would then generate and send a contest letter to the city on behalf of the user, aiming to overturn the ticket.

The Product

Fixed operates as a free app download, and users are charged a 35% success fee only if their parking ticket is successfully contested. The success rate was stated to be around 20% to 30%. The app focuses on identifying errors such as typos on license plates or missing information that could invalidate the ticket.

The business model involved a low-cost customer acquisition strategy. Instead of relying on traditional paid marketing, Fixed deployed a team to follow street-cleaning vehicles, placing flyers on cars with parking tickets. Hegarty mentioned a 70% retention rate among users, who, on average, received about six parking tickets per year.

The pitch also covered the cost structure, indicating that Fixed made around $5 to $6 in revenue per successfully contested ticket. The cost to acquire a customer was about $4 to $5, involving a combination of crowd workers, software, and street-level marketing.

How It Went

The company’s position before Shark Tank

Fixed had a valuation of $14 million, with a reported net revenue of $80,000 in the current year. Hegarty disclosed that the company had raised $1.8 million at a $10 million valuation cap in the last funding round. The growth rate was impressive, with a 33% month-over-month increase since January of that year. The app was already operational in several major cities, including San Francisco, Oakland, Los Angeles, and New York.

Hegarty projected an $11 million revenue run rate by the end of the year if the current growth trajectory continued. The company had acquired 40,000 users within a year, and the 70% retention rate indicated a promising customer base. However, concerns were raised about the overall sustainability of the business model. Some sharks expressed skepticism about the potential for significant growth, given the regulatory challenges and the app’s reliance on challenging government revenue sources.

The Negotiations:

Other sharks had expressed concerns about the business model and its potential to scale, with Chris Sacca and Kevin O’Leary opting out early in the pitch. Sacca was particularly skeptical about the scalability and market size, while O’Leary expressed concerns about potential conflicts with government regulations. The negotiations centered around Mark Cuban, who ultimately made an offer of $700,000 for a 7% equity stake, with an additional 2% structured as advisory fees.

This brought the total equity to 9%, and the deal was accepted by Hegarty. Cuban, on the other hand, saw an opportunity to disrupt a significant market, offering his expertise to help Fixed scale more efficiently. He acknowledged the challenges but believed in the app’s potential. The deal was closed with a handshake, and Hegarty expressed excitement about having Cuban on board.

In summary, while some sharks were skeptical about the scalability and regulatory challenges of Fixed, Mark Cuban saw potential and made a deal that included both investment and advisory expertise.